Nature Risk Made Simple: Your Step-by-Step Guide to Confident Disclosures

Introduction

The business world stands at a critical juncture. With more than $50 trillion in global GDP moderately or highly dependent on nature, companies can no longer afford to treat nature risk as an afterthought. Through regulations like the EU Corporate Sustainability Reporting Directive (CSRD) and investor demands for transparency, nature risk disclosures will be adopted as part of annual financial reporting over the next few years. Yet many sustainability managers feel unprepared for this challenge, unsure how to measure, assess, and disclose their company's relationship with nature.

The good news? You've likely already begun this journey without realizing it. If your company measures climate risk, tracks water usage, or monitors waste, you have a foundation upon which to build. This guide breaks down the complexity of nature risk disclosures into five actionable steps, helping you transform a daunting regulatory requirement into a strategic advantage for your business.

Step 1. Recognize that you have already started on nature

Step 2: Understand the basic nature risk framework

Step 3: Follow the recommended risk assessment process

Step 4: Develop strategic plans and set targets

Step 5: Invest in your business and value chain

“With more than $50 trillion in global GDP moderately or highly dependent on nature, companies can no longer afford to treat nature risk.”

Step 1: Recognize that you have already started on nature

In this step, we help you establish the right mindset for making progress on your nature journey.

Think of nature as the next step in your climate journey. Or, more appropriately, think of climate as the first step of your nature journey. If you are already measuring climate risk or GHG emissions, or setting climate targets, then you have a strong foundation for nature. Furthermore, you may already be working on nature without yet naming it, because nature includes water, waste, and circular business practices.

However there are a few important ways in which nature differs from climate.

1. Climate is one issue, while nature is many issues.

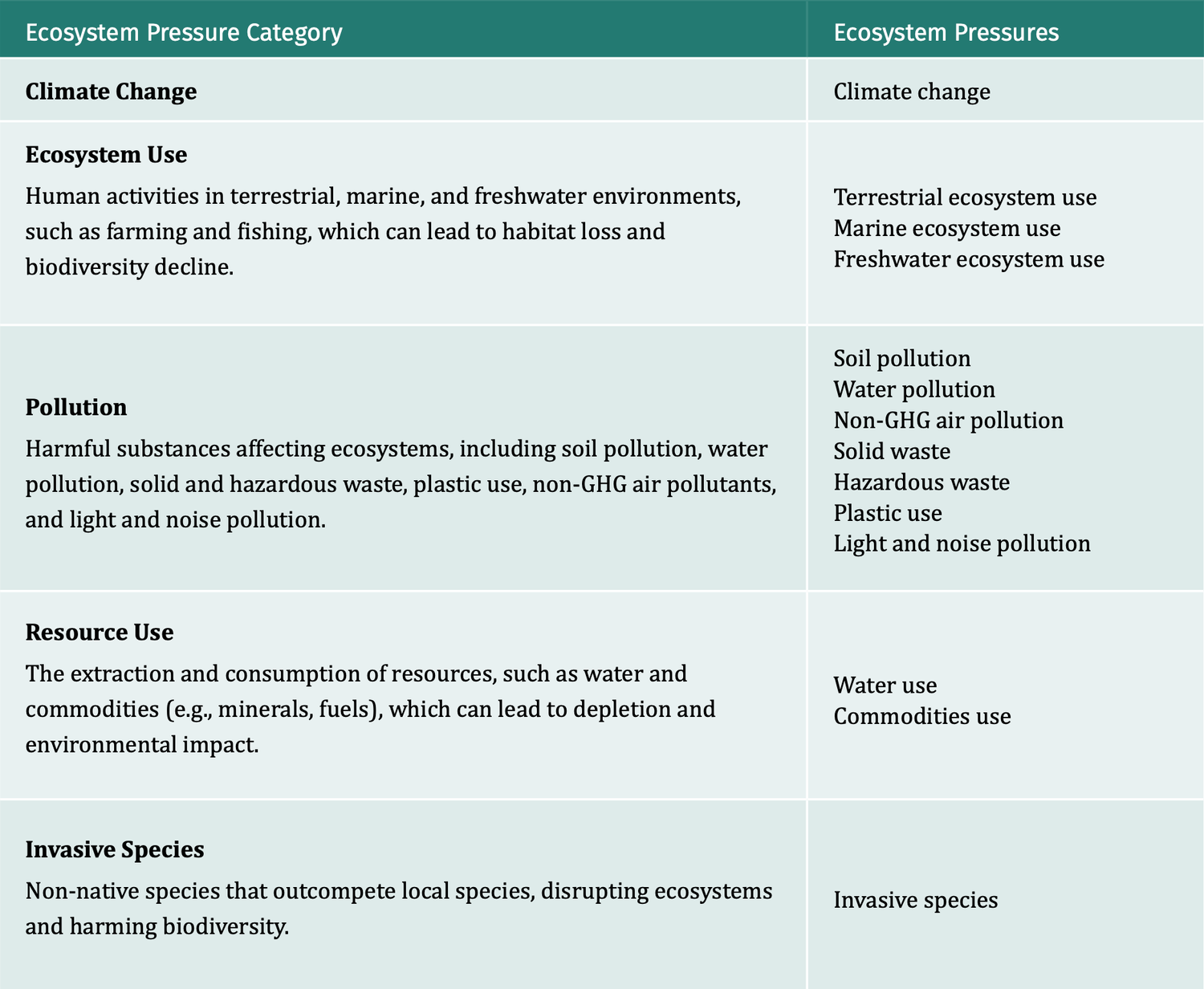

Climate is one component in the broad scope of nature, which also includes water and natural resource use, ecosystem use, pollution emissions, and invasive species. See Table 1 for the full suite of "Ecosystem Pressures" – corporate drivers of nature change. Consequently, nature cannot be summed up in a single impact metric like CO2e for climate. Instead, as nature disclosures evolve, the frameworks will converge on a suite of metrics.

2. Nature is local and non-fungible.

While GHG emissions produced anywhere create a global net warming effect, the other Ecosystem Pressures create local effects. Thus, restoring an ecosystem in one location will not offset the destruction of another. So while companies will need to invest in restoration for damages done in the past, restoration is not a solution for future damages – companies must transform their business operations to minimize environmental impacts.

3. There are no global models for nature.

For climate, there is global scientific consensus around a suite of models that predict climate change under different policy scenarios – the IPCC models. There are, for the most part, no globally recognized models for nature, with the exception of water stress (WRI Aqueduct). Thus, a different analytical approach is required for nature.

Table 1. List of Ecosystem Pressures

With these differences in mind, we turn to how nature risk analysis is similar – and in some ways easier – than climate risk analysis.

1. The TNFD framework mirrors the TCFD framework.

The TNFD (Taskforce on Nature-related Financial Disclosures) leverages the framework from the TCFD (Taskforce on Climate-related Financial Disclosures) as a starting point, so many of the governance requirements are the same. Thus, companies can build upon work already done, whereas most companies had to start from scratch with climate risk.

2. There is strong alignment across nature frameworks.

Unlike how climate disclosures requirements were developed, there has been a remarkable amount of collaboration among different developers of nature risk frameworks. The TNFD in particular has done a good job consulting existing nature frameworks, and the CSRD mandates point back to the TNFD as the "how to" guide. If companies follow the TNFD, they should easily be able to adapt their reporting to any other nature disclosures framework.

3. We are in a stronger position with nature.

Because nature reporting builds on the global frameworks for climate risk reporting, and many companies are already doing work on nature topics (e.g., water management), much of the foundational work is already done. Companies can leverage data already being collected and expertise already built for climate risk as a starting point to assess nature risks and opportunities.

What about biodiversity? Understanding the nature lexicon

"Biodiversity" is the hot new ESG topic, and the word itself is used in a number of different ways that can be confusing. We have seen it used to represent nature (e.g. biodiversity risk instead of nature risk), ecosystems (biodiversity loss), deforestation (also biodiversity loss), and of course species (plants and animals). Many companies assume that because they don't directly use species in their products, that biodiversity is not material.

Instead, we recommend that companies think holistically about "nature" as an umbrella term, of which biodiversity is a component. And in the context of nature disclosures, biodiversity serves as an indicator for ecosystem health, upon which businesses and the economy ultimately depend. This is because healthy ecosystems provide a bounty of ecosystem services that are vital to human health and the economy.

“Biodiversity serves as an indicator for ecosystem health, upon which businesses and the economy ultimately depend.”

Step 2: Understand the basic nature risk framework

In this step, we introduce some basic concepts that comprise the nature risk framework.

Double materiality

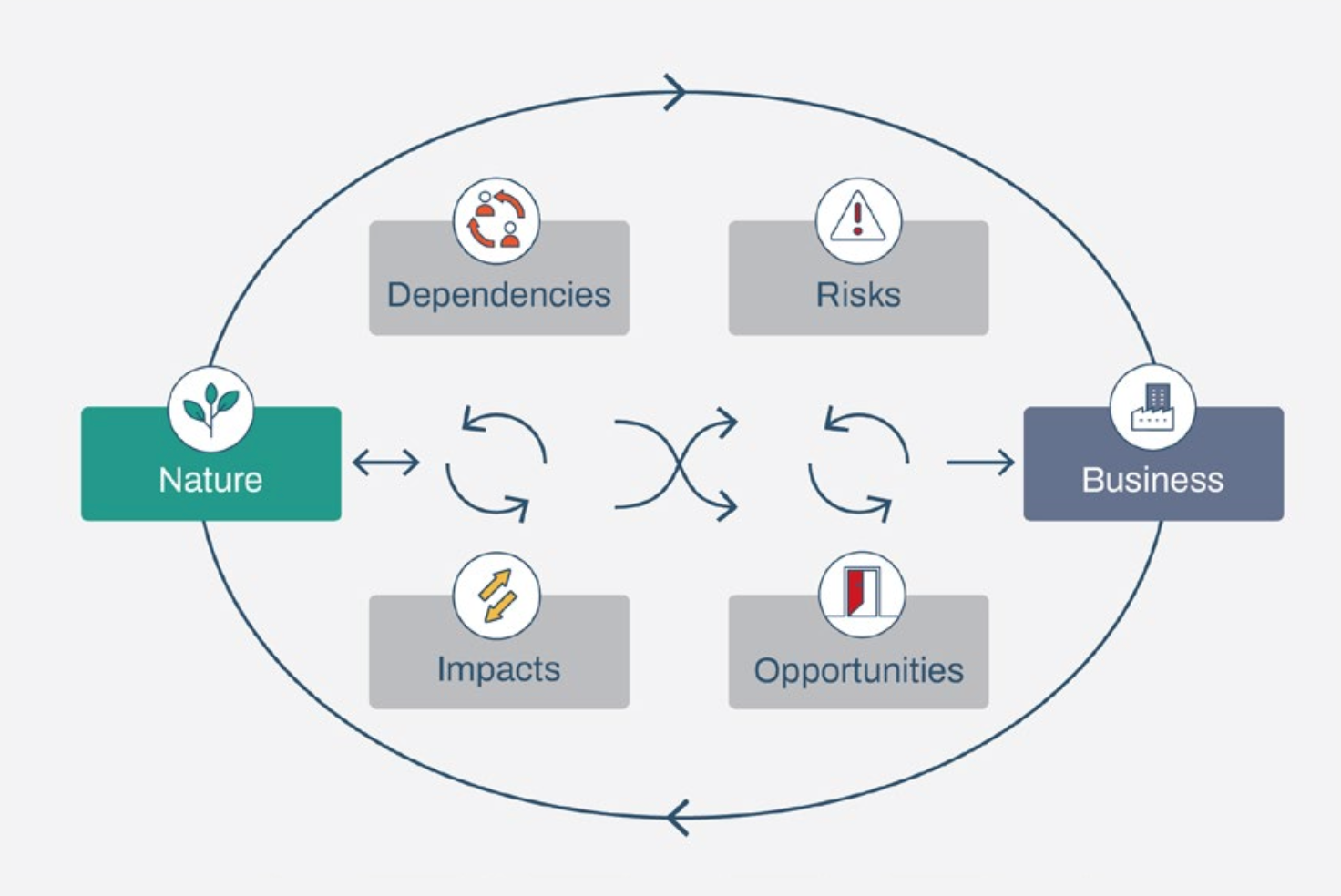

Double materiality simply considers both sides of your relationship with nature. On one side are the impacts that your firm's operations have on nature – these are usually negative, sometimes neutral, and hopefully increasingly positive going forward. On the other side are the implications for your firm related to nature, or financial materiality. This usually comes in the form of dependencies on natural resources (e.g., water, fish, or timber), ecosystem services (e.g., pollination or flood control), or transition risks (e.g., legal, reputational, or market risks).

Both impacts and dependencies on nature can result in material financial risks for a company, as well as opportunities. Figure 1 on the following page summarizes these.

Biodiversity materiality should be measured from the bottom up

The CSRD ESRS (European Sustainability Reporting Standards) mandate that companies shall disclose both known and potential material impacts. In reality, there are very few industries that have zero impacts to nature. While many companies currently complete their double materiality assessments using top-down or survey-based assessments, those methods are not fully CSRD-compliant and may yield misleading results in regard to biodiversity materiality – even if they end up being permitted in the first year of reporting.

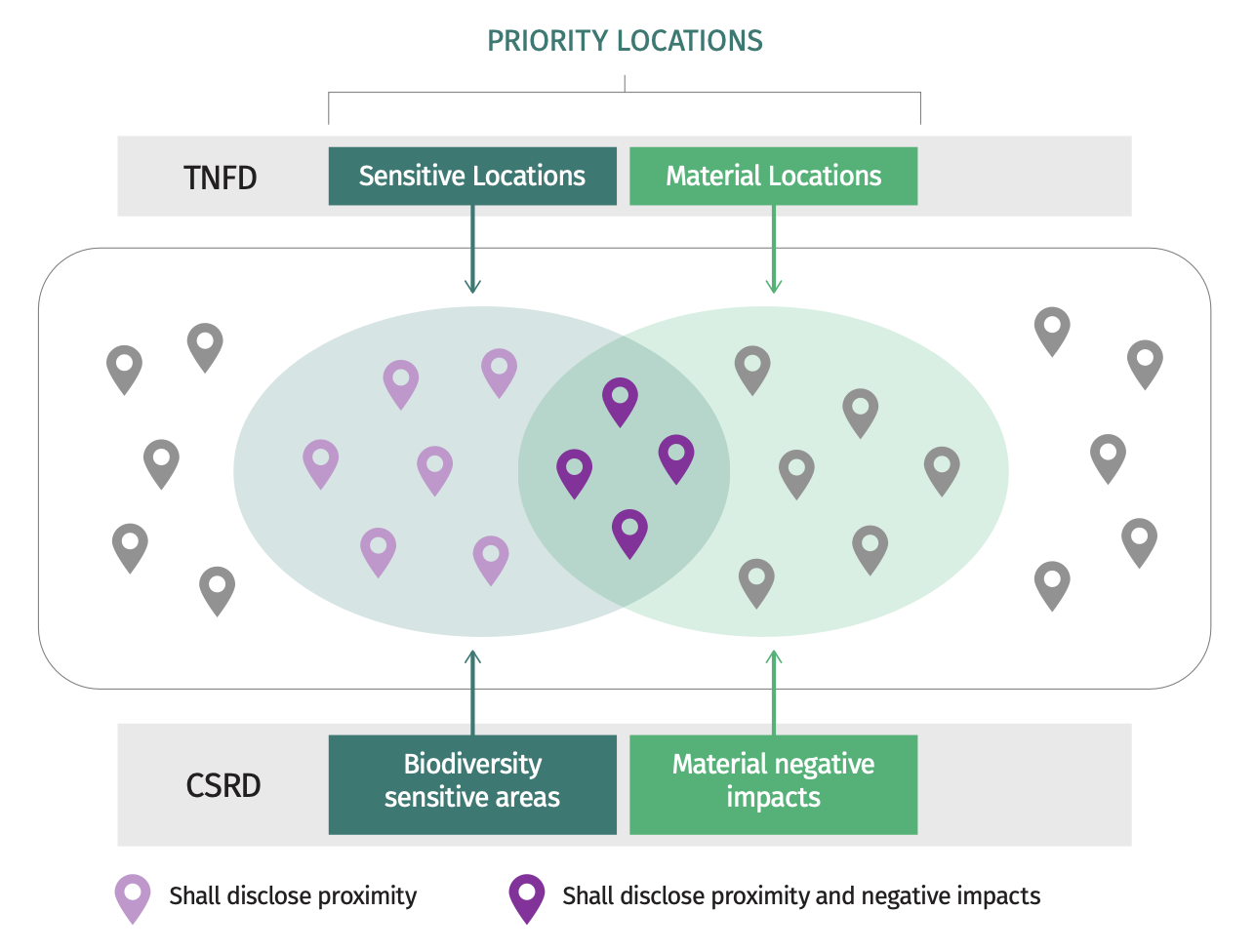

On the topic of biodiversity specifically, impacts and dependencies are localized to particular ecosystems, so biodiversity materiality can only be properly assessed from the bottom up, meaning by assessing each individual location where a company operates. This aspect of materiality is different from all others in a double materiality assessment.

At first, the topic of biodiversity may not seem to apply to your industry (e.g., if your company does not source organisms directly from nature). However, what many companies don't realize is that regardless of the outcomes of the double materiality assessment, under the CSRD ESRS, companies must disclose locations that are in proximity to biodiversity-sensitive areas.

Figure 1. The double materiality of a firm’s relationship with nature. Source TNFD.

The scope of nature risk disclosures

Nature risk disclosures frameworks, and the TNFD in particular with its "LEAP" approach (Locate, Evaluate, Assess, Prepare), guide a company to answer three basic questions:

1. What are you doing and where are you doing it?

To answer this, companies must identify the local ecosystem for each location where they (and the companies in their value chain) operate, and the Ecosystem Pressures (land/ocean area used, pollution emitted, resources used) they apply at those locations. Most companies already have much of this data, even if not collected in a central place or reported in a centralized way. This is the easier question to answer, and comprises the "Locate" step in the TNFD LEAP approach.

2. What do your activities mean for the ecosystems in which you operate?

This is a question most companies have never been asked before. A firm's responsibility has typically been limited to compliance with local regulations, not monitoring for the environmental impacts they may be having. Now they are being asked to measure impacts using scientifically appropriate methods to enhance transparency on externalities. This is the "Evaluate" step in the TNFD LEAP approach.

3. How does that translate to risks and opportunities for the firm?

This is ultimately what the investors and regulators requiring nature risk disclosures want to know. Are you financially dependent on natural resources that are being depleted? Are you damaging a legally protected area or an area important for people or biodiversity, for which you could be held accountable? This is the “Assess” step in the TNFD LEAP approach.

Why compliance with local regulations is no longer sufficient

If compliance with local regulations was sufficient, then trillions of dollars’ worth of natural resources and ecosystem services would not be destroyed every year. The depletion of natural capital has reached a point where it presents a serious financial risk to businesses and the economy, and with climate change, is set to get worse in the coming decades. To prevent economic instability – or worse, economic collapse – we need a mechanism to identify and manage the risk. Thus, it is in the long-term interest of every company to embrace nature risk management, and disclosures.

“To prevent economic instability – or worse, economic collapse – we need a mechanism to identify and manage the risk.”

Step 3: Follow the recommended risk assessment process

In this step, we explain how to implement the TNFD LEAP approach to assessing nature risk as outlined in the TNFD Recommendations (Figure 2).

Following this process should prepare you to meet most ESG disclosures frameworks for nature-related financial risks, including the CSRD.

The TNFD and other nature disclosures frameworks recommend or require quantified analysis where possible, acknowledging that methodologies for quantification are still under development. Companies should work to quantify as much as possible, or at least collect the data needed for future quantification efforts.

However, qualitative results may be sufficient for the first year of disclosures while the quantification mechanisms are being introduced and adopted.

Dunya Analytics' nature risk analytics solution makes it easy for companies to quantify financial risks associated with biodiversity and nature loss. We combine company operational information with third party datasets in our proprietary and transparent methodology to make nature risk assessment fast, easy, and affordable.

Figure 2. The TNFD LEAP approach for measuring and disclosing nature-related financial risk. Source TNFD.

Locate the interface with nature

The Locate step of the LEAP approach answers question 1, what are you doing and where are you doing it? The TNFD recommends that you analyze all of your "Business Activities" on two dimensions: material locations and sensitive locations.

Material locations are defined by the activities of your organization. They are the places where your organization identifies material nature-related dependencies, impacts, risks and/or opportunities, usually where you have material Ecosystem Pressures.

The Locate step should enable you to answer the following questions:

Which of our Business Activities are in areas important for biodiversity, Indigenous Peoples and Local Communities, or water stress?

Which of our Business Activities could be impacting legally protected areas or community lands, presenting a legal risk?

How should we prioritize our Business Activities from a nature risk perspective?

Figure 3. Visual Representation of TNFD recommendations and CSRD requirements. Adapted from the TNFD.

Evaluate dependences and impacts

The Evaluate step of the LEAP approach answers question 2, what do your business activities mean for the ecosystems in which you operate? Focusing on priority locations, this step involves a deeper analysis of your impacts and dependencies on nature, starting with the applicable Ecosystem Pressures or drivers of nature change.

At the time of this publication, the TNFD recommends 29 different metrics for the Locate and Evaluate steps of the LEAP approach. Download our free TNFD Metrics Map to see the metrics that cover these first two steps.

The Dunya Analytics platform also evaluates impacts and dependencies at a screening level, to help you identify and prioritize where onsite measurements should be made.

The Evaluate step should enable you to identify which are the most important Ecosystem Pressures for your business – key information for setting meaningful science-based targets and establishing strategic programs within the company.

For example, if you identify water use as a material Ecosystem Pressure for your business, you need to identify where your water use is most material. The Business Activity that uses the most water may not pose the highest risk. A Business Activity that uses a moderate amount of water, but is operating in an area of increasing water stress, and is in competition with ecosystems or people for that water, may be a much higher risk for the company.

Assess risks and opportunities

The Assess step in the LEAP approach answers question 3, how do your impacts and dependencies on nature translate into risks and opportunities for the company? In this step you should connect the dots between your impacts and dependencies, and financial materiality for the company. Risks and opportunities come in many forms, and are nicely segmented into 24 metrics in the TNFD. Consult the TNFD Recommendations or our TNFD Metrics Map for more details.

This step should yield very valuable insights for the company, both in identifying material financial risks and uncovering promising business opportunities.

Returning to the water use example in the previous section, once you have identified which locations have material risks associated with water use, you can connect the water use to company financials and answer questions like:

How much revenue depends on a dwindling water resource?

Where can we reduce operating costs by reducing water use?

Where might we face lawsuits, regulatory fines, or lose our license to operate because of our water use?

Prepare to respond and report

The last step in the LEAP approach, but not the last in your journey, is to disclose what you learned in the Locate, Evaluate, and Assess steps, and to prepare your response.

The backlash and subsequent legal implications of greenwashing have made some companies wary of communicating their sustainability progress (referred to as "greenhushing"). However, companies that provide a comprehensive view of their relationship with nature – celebrating the successes while acknowledging the work yet to be done – yield significant benefits, including:

Lower cost of capital

Stronger competitive positioning and customer loyalty

Increased trust from communities, regulators, and investors

These days, it is important for companies to be thoughtful about how they communicate sustainability initiatives, and we recommend this Harvard Business Review article to help companies navigate the complexities of sustainability communications.

Many companies are also nervous about measuring nature risk, and wonder if it means they will have to relocate operations if risks are identified. Hopefully not! Moving a business is expensive and can be devastating for local communities and economies dependent on that business operation. In fact, there are many things a company can do to address nature risks that are easy, affordable, good for the local community, and financially beneficial for the company. Following the process in this document can help you to identify and prioritize those responses to build a more profitable and resilient business.

“Connect the dots between your impacts and dependencies, and financial materiality for the company.”

Step 4: Develop strategic plans and set targets

Once you have a clear view of your company’s risks and opportunities associated with nature, you need to develop an action plan. Diligence in quantifying risks and opportunities arms you with a business case for investing in sustainability initiatives.

Take action on high priority sites first

Many corporate sustainability initiatives are made opportunistically, in response to a scandal, or for marketing purposes. Following the TNFD LEAP approach will yield a priority list of evidence-based potential actions, enabling you to prioritize the most financially important or highest-impact actions first.

As with measurement, there are two components to a nature action plan: materiality and location. Following the LEAP approach, you should be able to identify material ecosystem pressures around which to build programs or targets, such as freshwater, land use or waste. You should also be able to identify the Business Activities that would be in scope for setting and delivering on the targets.

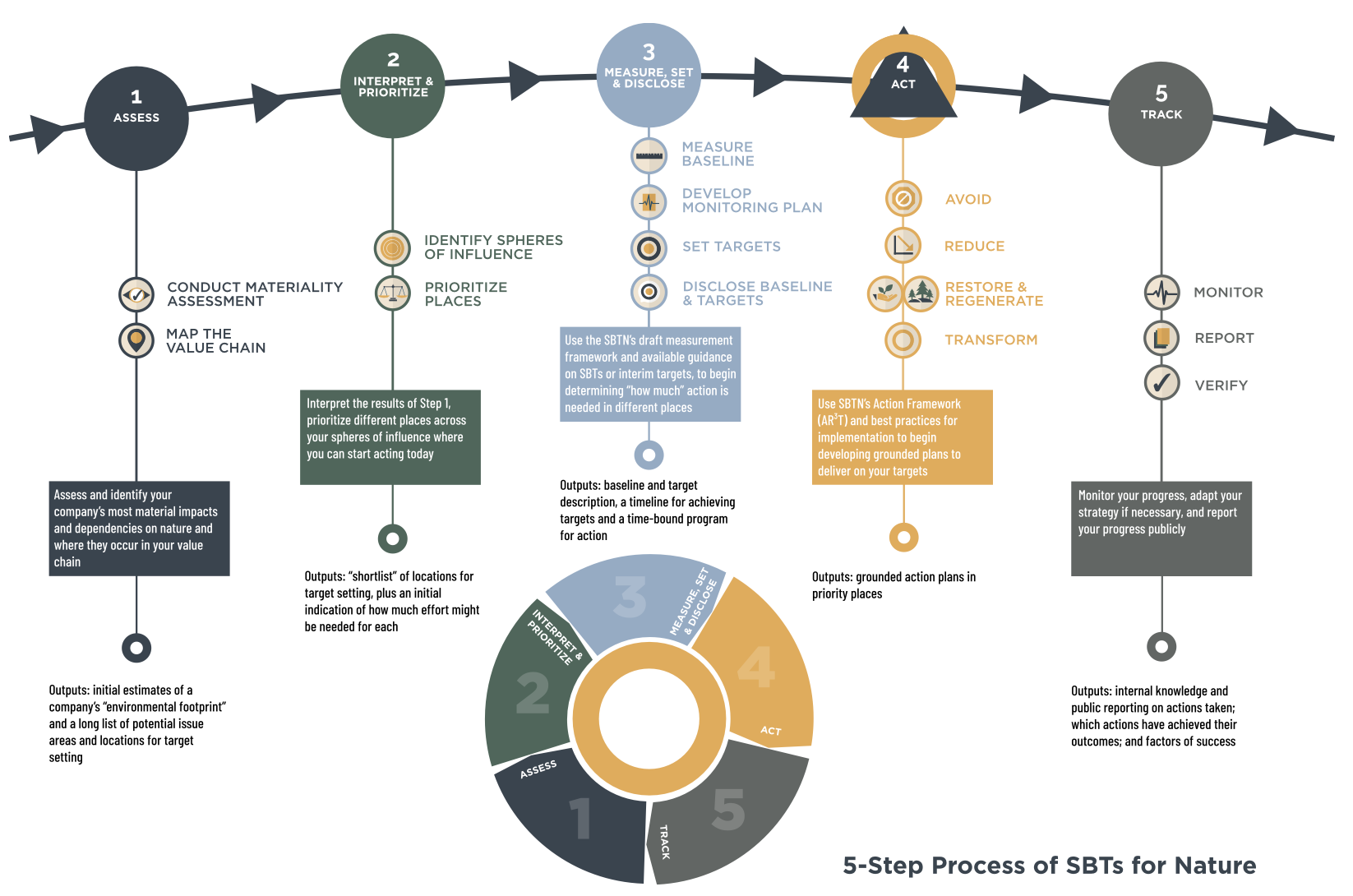

Set science-based targets using the SBTN framework

Completing the TNFD LEAP approach assessment also provides a scientific basis for setting targets for nature. It aligns with Step 1 - Assess and Step 2 - Prioritize of the Science Based Targets Network (SBTN) target-setting approach. You should be able to identify which actions and investments will create the foundation for credible, achievable science-based targets. Figure 4 summarizes the SBTN target-setting approach.

Consult the SBTN website for technical guidance on setting science-based targets for nature for:

Freshwater

Land

Ocean

Biodiversity

Figure 4. The SBTN target-setting approach. Source SBTN.

Step 5: Invest in your business and value

For many companies, the greatest nature risks and opportunities lie upstream or downstream in their value chains.

Assessing risk upstream may uncover opportunities to invest in community-led projects within the supply chain, or to collaborate with suppliers on business transformation initiatives. Looking downstream can identify opportunities for circularity or customer collaborations around business innovation.

Make it about innovation

Virtually all companies will need to take action to reverse their negative impacts on nature and mitigate business risks. Companies that are doing this successfully today make it about innovation. For example, a large consumer electronics company tasks its engineering team with an innovation challenge to develop a new device that has zero emissions or environmental impact, but they can't compromise the user experience or increase costs. Engineers love these types of difficult challenges, and employees find them meaningful and inspiring overall. Embracing environmental constraints uncovers new approaches, new solutions to meeting customer needs sustainably.

Consider the cost of inaction

Conducting a nature risk analysis should also reveal potential consequences of inaction. These insights and projected financial impacts should be incorporated into decision making for sustainability investments. Many companies only look at costs and benefits of taking action, but including the cost of inaction will yield a more accurate return on investment.

Experiment with all the tools at your disposal

There are numerous approaches to addressing each type of challenge, from implementing new processes, adopting new technologies, and transforming business models to engaging communities to restore ecosystems, employees to innovate, and value chain partners to reinvent. Inspiration and industry best practices can be found in Business for Nature's Sector Actions Towards a Nature-Positive Future and the TNFD Sector Guidance.